Social Media Calendar

Enough content to post to your social media feed every other day. In between these posts, we recommend making posts that are more personal and related to your local community.

These are the same images and wording sent weekly in the automated posts.

December 2025 Social Media Posts

DECEMBER 1ST

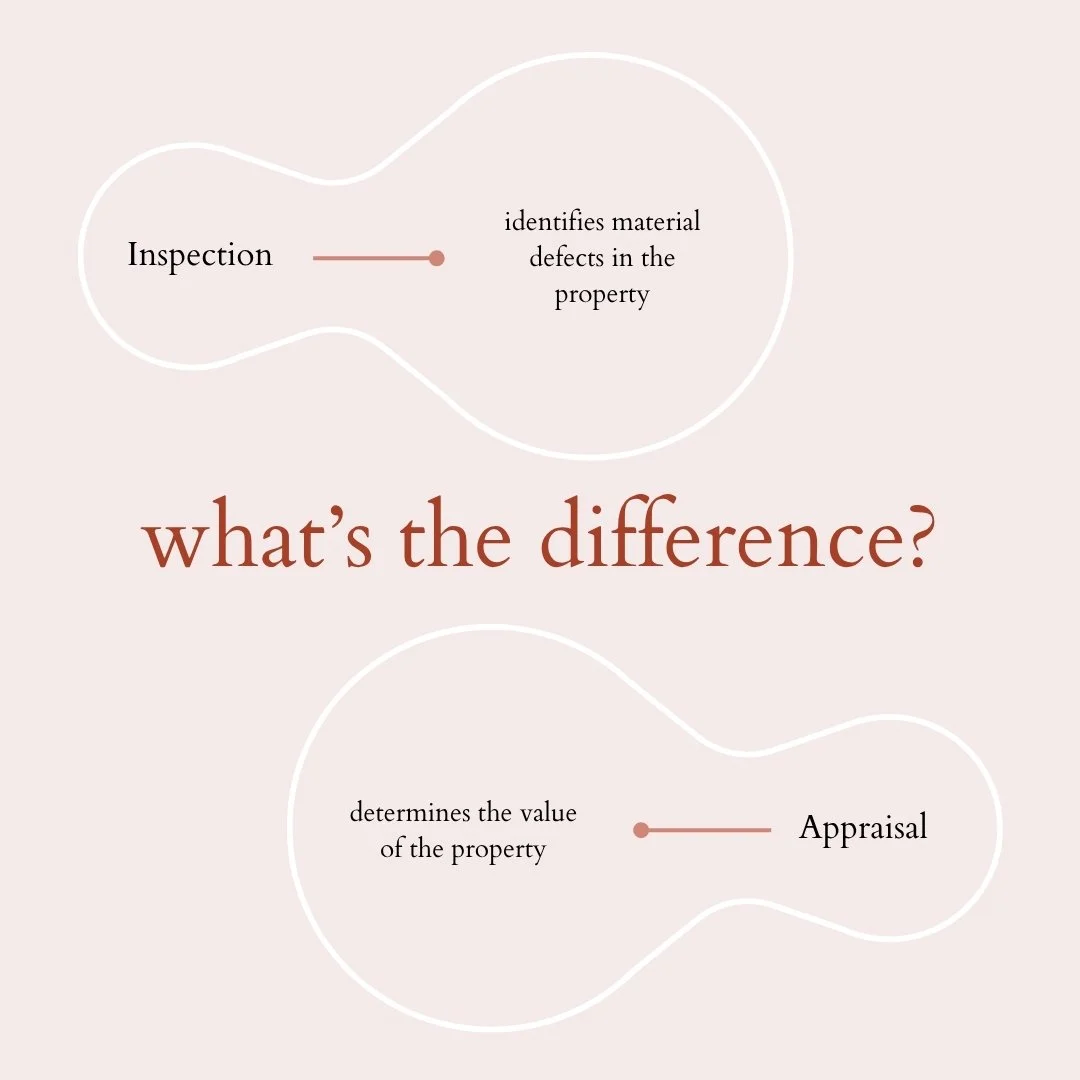

Caption: An inspection and an appraisal serve different purposes in the home-buying process. An inspection is conducted by a home inspector to evaluate the property's condition, identifying potential issues like structural problems, faulty wiring, or plumbing concerns. Its primary goal is to inform the buyer about the home's condition and potential repair needs. In contrast, an appraisal is conducted by a licensed appraiser to determine the property's fair market value based on factors like its condition, location, size, and recent comparable sales.

Appraisals are typically required by lenders to ensure the property is worth the loan amount being financed. While inspections focus on the home's functionality, appraisals focus on its financial value.

DECEMBER 3RD

Caption: Property taxes are a levy imposed by local governments, such as cities, counties, or municipalities, to fund public services like schools, roads, and emergency services. They are calculated based on the assessed value of your property, which is determined by a local assessor.

The tax rate, often referred to as a millage rate, is applied to this assessed value to determine the amount owed annually.

Property taxes can vary widely depending on the location, size, and value of the property, as well as local tax laws.

Typically, they are paid annually or semi-annually, either directly by the homeowner or through an escrow account managed by a mortgage lender.

DECEMBER 5TH

Caption: Knowing how much home you can truly afford before buying is essential for making a smart and sustainable financial decision. Many buyers focus only on the mortgage payment, but true affordability includes property taxes, homeowners insurance, maintenance, utilities, and potential HOA fees. Overextending your budget can lead to financial stress, making it difficult to cover unexpected expenses or save for future goals. Lenders may approve you for a higher loan amount than what's comfortable for your lifestyle, so it's important to analyze your monthly income, debts, and long-term financial plans. By setting a realistic budget and sticking to it, you can enjoy homeownership without sacrificing financial stability or peace of mind.

DECEMBER 8TH

Caption: The time frame for selling a home is influenced by several factors, starting with the local real estate market conditions. In a seller's market, where demand exceeds supply, homes tend to sell faster, while in a buyer's market, where there are more homes available than buyers, sales can take longer. The home's price also plays a crucial role; if priced too high, it may deter buyers and lead to a longer selling period, while a competitively priced property can attract quicker offers. Additionally, the condition of the home, its location, and its appeal to buyers-such as updated features or a well-maintained exterior-can either expedite or delay the sale. External factors like the season can also impact the time frame; homes tend to sell faster in spring and summer when buyers are more active, compared to the slower winter months. Lastly, the seller's flexibility in negotiating terms and the buyer's financing process can further affect how quickly a sale is finalized.

DECEMBER 10TH

Caption: Fair market value is determined by what a willing buyer is ready to pay and what a willing seller is willing to accept, without any pressure or compulsion. It takes into account factors like the property’s location, condition, size, and comparable sales of similar homes in the area, known as ‘comps’. Fair market value (FMV) in real estate is determined using three main approaches: the sales comparison approach, the cost approach, and the income approach. The sales approach compares a property to similar recently sold homes, while the cost approach estimates the replacement cost minus depreciation. The income approach is used for properties that generate income and is based on future earning potential.

DECEMBER 12TH

Caption: Open houses can be an effective tool for selling a home when used strategically. They work best when the property is in a desirable location, has unique features, or is priced competitively within the market. Hosting an open house allows potential buyers to explore the home in a relaxed, no-pressure environment, which can lead to stronger emotional connections with the space. It can also attract local buyers who may not have considered the property initially but are intrigued once they see it in person. Open houses are particularly useful when a home has been newly listed or is in a competitive market, where visibility is key. However, they are most effective when marketed well - through social media, listing sites, and signs - ensuring that the event draws a significant crowd. When organized at the right time, with the right strategy, open houses can generate interest, increase foot traffic, and help sellers secure offers faster.

DECEMBER 15TH

Caption: Due diligence in real estate is the period of time between an accepted offer and closing. It is during this time that the buyer and seller agree to allow the buyer to inspect the property before closing the sale. In other words, it ensures you, the buyer, are getting what you're paying for, and that your lender is comfortable funding your purchase. Find out what happens during the due diligence period and why doing your homework can pay off in the end.

DECEMBER 17TH

Caption: Home appraisals are crucial for home sellers because they provide an unbiased, professional assessment of a property's value based on various factors such as condition, location, and comparable sales in the area. A solid appraisal ensures that the home's listing price aligns with its true market value, preventing potential buyers from undervaluing the property. It also helps sellers avoid overpricing, which can lead to extended market time and diminished buyer interest. Additionally, a well-conducted appraisal provides peace of mind to both sellers and buyers, facilitating smoother negotiations and reducing the likelihood of financing issues if a buyer's lender requires an appraisal to approve the loan. In short, a home appraisal is essential for establishing a fair price, streamlining the sales process, and ultimately helping the seller achieve a successful sale.

DECEMBER 19TH

Caption: Your credit score plays a crucial role in securing a mortgage, yet many myths about it can cost you your dream home. One common misconception is that checking your own credit score will lower it—this is false! Soft inquiries, like checking your own score, have no impact, while only hard inquiries from lenders may temporarily affect it.

Another myth is that closing old credit accounts improves your score, but in reality, it can shorten your credit history and reduce your available credit, which may lower your score. Additionally, many believe you need a perfect score to get a mortgage, but most lenders offer competitive rates to buyers with scores in the mid-600s or higher.

Understanding these myths and taking the right steps to maintain a healthy credit score can make all the difference in securing the best mortgage rates and achieving homeownership.

DECEMBER 22ND

Caption: When selling a home, the seller typically does not receive the full sale price due to various costs and fees. On average, sellers take home about 85% to 90% of the sale price after deducting expenses like real estate agent commissions, closing costs, repairs, and. staging. Depending on the remaining mortgage balance after fees, the true take home amount can vary drastically.

DECEMBER 24TH

Caption: Getting pre-approved for a mortgage is a crucial first step in the home-buying process, giving you a clear idea of how much you can afford and making you a more competitive buyer. To get pre-approved, start by gathering key financial documents, including proof of income (pay stubs, W-2s, or tax returns), bank statements, and information about your debts and assets. Next, check your credit score, as lenders use it to determine your eligibility and interest rate. Then, shop around for lenders and submit a mortgage application, allowing them to review your financial history and provide a pre-approval letter stating the loan amount you qualify for. A pre-approval not only helps streamline your home search but also signals to sellers that you're a serious buyer, increasing your chances of securing your dream home.

DECEMBER 26TH

Caption: Location, size, property age, and property value are crucial factors when buying a home because they directly affect both your quality of life and the home's future resale potential. Location determines access to amenities. schools, and job opportunities, while size impacts comfort and functionality. Property age can Influence maintenance costs and renovation needs. Lastly, property value reflects the home's worth and its potential to appreciate over time, making it a key factor for long-term investment. Balancing these elements helps ensure a smart purchase.

DECEMBER 29TH

Caption: Ever wonder what a realtor can really do for you? Behind every smooth home sale or successful purchase is a professional navigating the details you never see — pricing strategy, market insights, negotiations, paperwork, inspections, timelines, and a network of trusted pros. A great realtor protects your interests, saves you time, minimizes stress, and helps you make confident decisions in one of life’s biggest financial moves. Whether you’re buying, selling, or just exploring your options, having an expert in your corner makes all the difference.

DECEMBER 31ST

Caption: The new year is the perfect time to reset, refocus, and set intentional real estate goals. Whether you're dreaming of buying your first home, upgrading to a space that fits your lifestyle, or finally preparing to sell and maximize your equity, now is the moment to map out your plan. Start by reviewing your finances, exploring market trends, and defining what ‘home’ truly means for your next chapter. Big or small, every goal becomes more achievable with a clear strategy — and the right guidance to help you get there